Excitement About Mileagewise - Reconstructing Mileage Logs

Excitement About Mileagewise - Reconstructing Mileage Logs

Blog Article

The Facts About Mileagewise - Reconstructing Mileage Logs Revealed

Table of ContentsThe 25-Second Trick For Mileagewise - Reconstructing Mileage LogsThe Definitive Guide to Mileagewise - Reconstructing Mileage LogsThe Of Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedHow Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.The Best Guide To Mileagewise - Reconstructing Mileage LogsThe 10-Minute Rule for Mileagewise - Reconstructing Mileage Logs

Timeero's Shortest Range feature recommends the shortest driving course to your workers' location. This feature enhances productivity and contributes to set you back savings, making it a vital asset for businesses with a mobile workforce.Such a method to reporting and compliance simplifies the often complex task of managing gas mileage costs. There are lots of benefits connected with making use of Timeero to keep track of gas mileage.

Not known Facts About Mileagewise - Reconstructing Mileage Logs

These added verification procedures will certainly keep the Internal revenue service from having a factor to object your gas mileage records. With exact gas mileage tracking technology, your workers do not have to make rough mileage estimates or even worry about gas mileage expense tracking.

For instance, if a staff member drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all automobile expenditures. You will require to continue tracking gas mileage for work also if you're using the real expenditure approach. Maintaining mileage documents is the only means to different company and personal miles and supply the proof to the internal revenue service

Most gas mileage trackers allow you log your journeys by hand while determining the distance and compensation amounts for you. Lots of likewise come with real-time journey monitoring - you need to begin the app at the beginning of your trip and quit it when you reach your last destination. These applications log your start and end addresses, and time stamps, together with the overall distance and repayment amount.

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

One of the questions that The INTERNAL REVENUE SERVICE states that car expenditures can be considered as an "ordinary and necessary" cost in the course of doing organization. This consists of prices such as fuel, upkeep, insurance coverage, and the automobile's depreciation. Nevertheless, for these prices to be taken into consideration insurance deductible, the automobile needs to be used for service objectives.

Some Known Factual Statements About Mileagewise - Reconstructing Mileage Logs

In between, carefully track all your company journeys keeping in mind down the beginning and ending readings. For each trip, document the place and business function.

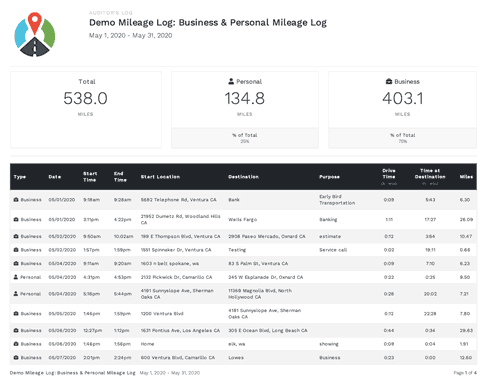

This consists of the complete business gas mileage and overall gas mileage build-up for the year (organization + individual), trip's day, location, and function. It's important to tape tasks without delay and keep a synchronic driving log outlining date, miles driven, and service objective. Right here's just how you can enhance record-keeping for audit functions: Start with ensuring a thorough mileage log for all business-related travel.

The Main Principles Of Mileagewise - Reconstructing Mileage Logs

The real costs technique is a different to the common mileage rate approach. Rather than calculating your reduction based on a fixed rate per mile, the real expenses approach permits you to deduct the actual prices linked with utilizing your lorry for business functions - best mileage tracker app. These costs consist of gas, upkeep, repair services, insurance coverage, depreciation, and other related expenses

Those with significant vehicle-related expenditures or unique conditions may profit from the actual expenditures technique. Please note electing S-corp standing can change this calculation. Inevitably, your chosen approach should line up with your certain economic goals and tax circumstance. The Standard Mileage Rate is a measure released each year by the internal revenue service to establish the insurance deductible costs of running an automobile for business.

The Greatest Guide To Mileagewise - Reconstructing Mileage Logs

(https://dzone.com/users/5245873/mi1eagewise.html)Calculate your complete business miles by using your beginning and end odometer readings, and your tape-recorded organization miles. Accurately tracking your precise mileage for company trips help in confirming your tax obligation deduction, especially if you decide for the Requirement Gas mileage method.

Maintaining track of your mileage by continue reading this hand can need diligence, but remember, it can conserve you cash on your taxes. Tape the total gas mileage driven.

9 Easy Facts About Mileagewise - Reconstructing Mileage Logs Shown

In the 1980s, the airline industry came to be the first commercial individuals of GPS. By the 2000s, the shipping sector had actually taken on GPS to track bundles. And now almost everyone makes use of GPS to obtain around. That implies almost everyone can be tracked as they deal with their service. And there's snag.

Report this page